How AI Solutions Meet Complex Challenges in Financial Services

In this first installment of a two-part financial services blog post series, we will examine how AI is improving compliance systems and reducing the effort required to run them.

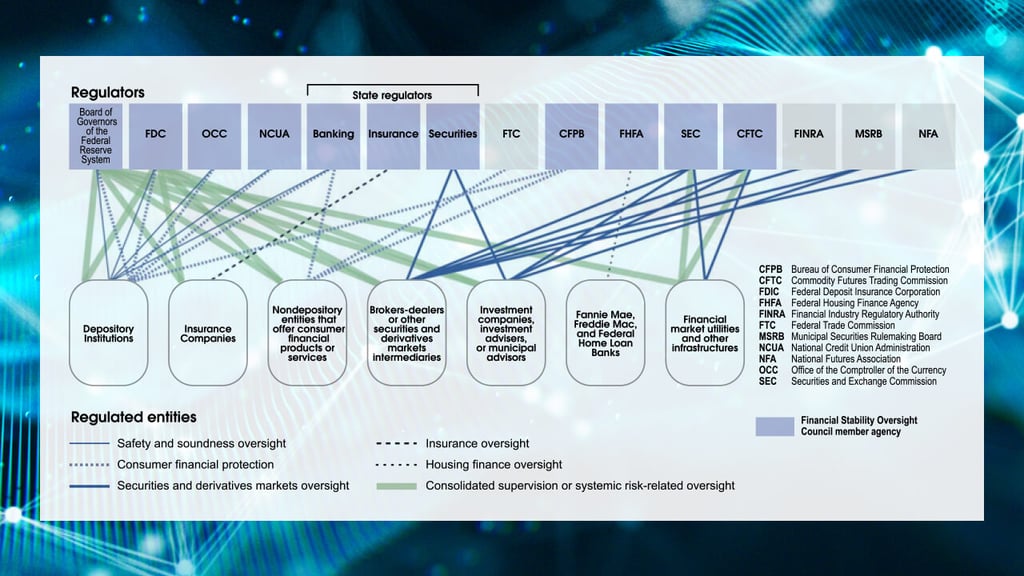

Figure 1. Regulatory Jurisdiction by Agency and Type of Regulation1

Worldwide, the financial services industry is under heavy regulation that is constantly changing, increasingly intrusive, and making it harder and harder on compliance officers everywhere. The US Securities and Exchange Commission (SEC) frequently introduces new regulatory action and even maintains a daily update page to help organizations keep up. It collected $4.68B in fines last year. Meanwhile, penalties levied by the European Union’s General Data Protection Regulation (GDPR) increased by almost 40%. At the state level, California’s privacy rights act is paving the way for similar initiatives in Washington, New Hampshire, and Illinois. The stage is set for a living web of regional regulatory requirements.

This never-ending torrent of new rules is overwhelming not just for compliance and risk officers, but also the IT teams tasked with deploying systems to help manage the constantly evolving requirements. And while these regulatory efforts are well-intentioned, they are driving up compliance costs for financial institutions that are also experiencing seismic changes in how they operate.

The expansion of digital banking into every corner of the financial services ecosystem and beyond has heightened the need for more robust, agile compliance measures. From mortgage lenders to investment bankers, visionary financial services organizations are using AI to keep pace, improving their compliance programs and mitigating costs.

A new path to compliance

Traditional compliance tools designed using a rule-based reporting model for structured data cannot keep pace with the increasing velocity of data that no longer fits neatly into rows and columns. Firms cannot wait the hours, days, or months it now takes to wrangle the data and identify compliance issues. They need to be able to ensure regulatory compliance in real time.

To address the deluge of customer and transactional data, forward-looking financial services organizations are turning to next-generation AI, natural language processing (NLP), and deep learning to discover new patterns that exist in these disparate, unstructured datasets. AI further augments human resources by automating and accelerating rules-based architectures prone to a high false positive rate and downstream manual processing. As AI models ingest more and more data, they will become more accurate — allowing firms to address trends or shifts (model creep) in near real time speed.

Organizations are breaking free of existing technology paradigms to adapt to changing regulations. Embracing AI leaves behind the siloed technology services, that rely too heavily on cumbersome and error-prone manual integration processes, to identify communications anomalies, input patterns associated with fraud, and identify exceptions to established rules.

AI detects patterns and anomalies and performs error correction at scale — leveraging data to regularly improve accuracy and reduce the downstream exceptions that require manual intervention. AI can also break down data silos, integrate unstructured data, and bridge gaps between data connection points.

This is the best way for financial services firms faced with mountains of diverse structured and unstructured data to accelerate and automate anomaly detection and correction.

NLP puts the context in compliance

The NLP component of AI is vital to compliance automation. Unlike software algorithms that create thousands of rules to sift through mountains of stale historical data searching for specific words, NLP can identify context and determine intent. For instance, an algorithm on the hunt for specific words or phrases will raise a red flag for “I promise to sell you these shares for $7.50 each.” However, those intent on bending or breaking the rules also understand that these systems would not necessarily catch, “On the 7th hole, I got an eagle, and my score is 50.”

NLP can break these types of codes because it learns and understands terminology in context and continually gains greater accuracy through machine learning. NLP does more than identify keywords. It looks at a sentence or paragraph for context and intent and goes far beyond a single data set — seeing patterns that exist in vast amounts of unstructured data. As the volume of data from various sources, such as documents, emails, phone calls, chat windows, and even social media grows over time, the large models improve predictability and identify more outliers by training with the most current data.

Augmenting compliance intelligence with AI

Currently federal regulators oversee 76 specific areas that are constantly changing. AI will help map the impact of these changes on existing business processes and contracts.

As more data connections are made and large NLP models evolve, AI solutions automate and accelerate compliance processes. Improved model accuracy also reduces manual exceptions. More decisions are made in an automated workflow and only the most delicate and nuanced exceptions are laid at the feet of overworked compliance officers. Tools such as NLP can even capture regulatory changes as they happen — making it easier to prepare for audits, reducing the risk of fines, and helping to lower overall compliance costs.

The promise of AI in financial services is one part of the larger picture. AI solutions are built on models that constantly iterate and improve, thriving on larger datasets that are growing exponentially. Governance of AI models is of keen interest to regulators intent on ensuring they are producing fair, accountable, and transparent decisions. The next installment in this two-part series will address the AI regulatory landscape, discuss the creation and iteration of large AI models related to compliance, and dive deeper into the mechanics of compliance-related AI solutions — specifically Dataflow-as-a-Service™.

Learn More

- Read the whitepaper: Breakthrough Efficiency in NLP Model Deployment

- See the e-book Discover What’s Possible with Next-Generation AI

- Learn more about our solutions for the Financial Services industry